Uninsured and Underinsured Motorist Claims in Texas

Potential clients often contact my office for help after a collision with an uninsured driver. Though most potential clients claim to have “full coverage,” many drivers do not have the coverage necessary to help them if they are injured by an uninsured driver. If this potential client does not have uninsured or underinsured (“UM/UIM”) coverage, my office has to break the bad news that it could be very difficult—if not impossible—to recover damages even though the other driver caused the collision.

What is Liability Insurance?

Automobile liability insurance is third-party insurance that protects the policyholder when he or she causes property damage or bodily injuries to a third party while using a car. In Texas, all drivers must maintain at least $30,000.00 of coverage for personal injuries per claimant—up to a total of $60,000.00 for all claimants—and at least $25,000.00 of coverage for all property damage. These minimum liability policies are known as “30/60/25 policies.”

In a perfect world, all motorists would carry minimum liability policies, and minimum liability policy limits would be sufficient to cover all injuries. Unfortunately, some motorists drive without liability insurance, and many injuries are so severe that minimum liability policies are not enough to compensate a victim fully. This is why many drivers purchase UM/UIM insurance.

What Is UM/UIM Insurance?

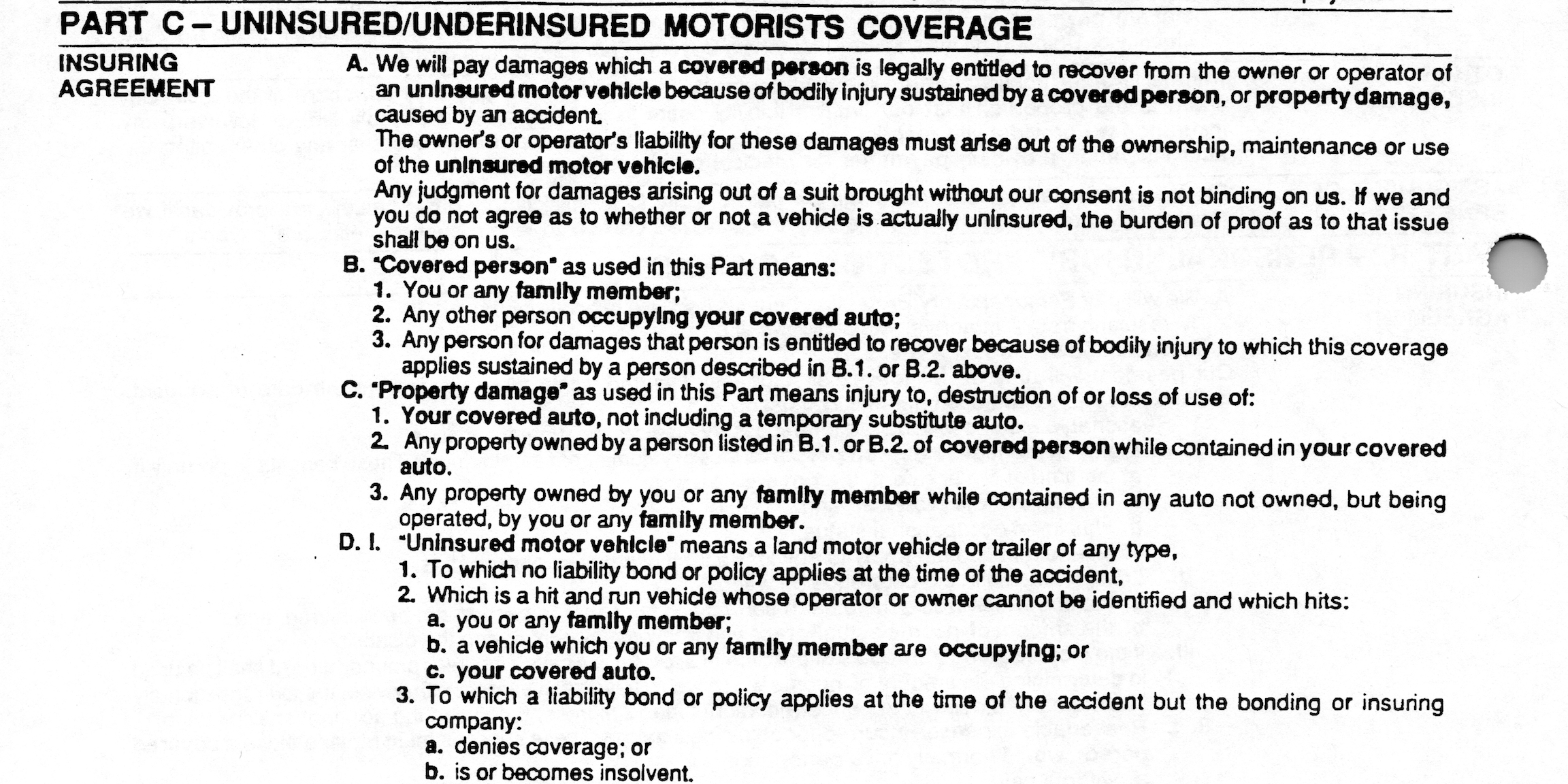

UM/UIM insurance is first-party coverage that protects the policyholder when the at-fault driver is either uninsured or has insufficient liability insurance to cover the policyholder’s injuries. In Texas, insurance companies are required to offer UM/UIM insurance when selling auto policies, but the policyholder may reject this coverage in writing. The policyholder can purchase UM/UIM insurance at the same 30/60/25 default limits mentioned above or can purchase higher policy limits so long as they do not exceed the policyholder’s liability limits.

When Does UM/UIM Insurance Apply?

Usually, UM/UIM coverage is triggered in one of three scenarios:

No liability insurance - A crash victim can file a UM/UIM claim if he or she is injured by a driver who was not covered by a valid liability policy at the time of the collision. Sometimes, liability carriers will deny a claim even though the at-fault driver initially appears to be covered. The two most common reasons why a liability carrier would deny a claim for lack of coverage are: (1) the at-fault driver is excluded from the policy; (2) the policyholder failed to pay the required premiums on time.

Insufficient liability insurance - A crash victim can also file a UM/UIM claim if the at-fault driver’s liability policy limits are not high enough to cover the policyholder’s damages. A policyholder does not have to recover the at-fault driver’s liability policy limits to file a UM/UIM claim, but the UM/UIM carrier receives an offset for the at-fault driver’s policy limits.

Hit-and-run driver - Lastly, a crash victim can file a UM/UIM claim if he or she is injured by a hit-and-run driver. To trigger coverage under a UM/UIM policy, there must be actual physical contact between the hit-and-run driver’s vehicle and the victim’s person or property.

Who Is Covered By a UM/UIM Policy?

For many years, the Texas Department of Insurance required all auto insurance companies to use a standard policy with identical terms, definitions, and provisions. This simplified policy analysis because all Texas policies were the same.

This changed in the mid-2000s when the Texas legislature gave insurance companies the power to create their forms. As a result, insurance companies have more flexibility to deny coverage by limiting who is covered by their policies. Therefore, one must read the specific UM/UIM policy—and review its definitions and exclusions—to determine whether a particular person is covered. Generally speaking, though, UM/UIM policies are designed to cover the policyholder, and most UM/UIM policies also cover the policyholder’s family and those injured while occupying a covered vehicle.

What Benefits Does a UM/UIM Policy Provide?

Once a claimant establishes coverage under a UM/UIM policy, he or she is entitled to recover all amounts that he or she is legally entitled to recover from the at-fault driver up to the UM/UIM policy limits. Since UM/UIM coverage is first-party insurance, it is also subject to the Texas Deceptive Trade Practices Act, the Prompt Payment of Claims Act, and the common-law duty of good faith and fair dealing. If applicable, these extra-contractual causes of action could open the door to recovering more than the UM/UIM policy limits. The Texas Supreme Court’s Brainard opinion, though, seems to have made that possibility more academic than real.

Hire an Injury Lawyer With Experience Handling UM/UIM Claims

This post does not begin to scratch the surface of the complexities of UM/UIM policies and claims (and the pages of cases interpreting terms like “legally entitled to recover” and “actual physical contact”). If an uninsured or underinsured driver has injured you or a loved one, you have enough things to worry about. Do not let navigating through the complexities of a UM/UIM policy and negotiating with an experienced adjuster be some of them. We deal with the insurance company so you can focus on getting your life back to normal. You have one chance to do this; make the right choice by choosing the right attorney. Call us at (956) 291-7870 or email us at contact@rdjlawyer.com for a free consultation and case evaluation.