The Importance of Gap Insurance When Financing a Car

Many new car buyers believe that they are not obligated to continue paying their auto loans when an insurance company totals their vehicle. Unfortunately, this mistaken belief leaves many car owners on the hook for underwater auto loans after a total loss.

What Property Damages Can a Car Owner Recover After a Collision?

After a car accident, Texas law allows a victim to recover compensatory damages from the at-fault driver and the driver’s liability insurer. Compensatory damages put the victim in the same position that the victim would have been in had the collision not occurred. Regarding property damage, this means getting reimbursed for necessary repairs or receiving compensation for the vehicle’s fair market value.

A vehicle’s market value is the price that vehicle would bring if offered for sale by a willing seller and purchased by a willing buyer. If the cost of repairs is relatively close to a vehicle’s market value, the liability carrier is likely to “total” it. Totaling a vehicle means the insurance company chooses to reimburse the owner for the car’s market value rather than pay for its repairs.

What is Gap Insurance?

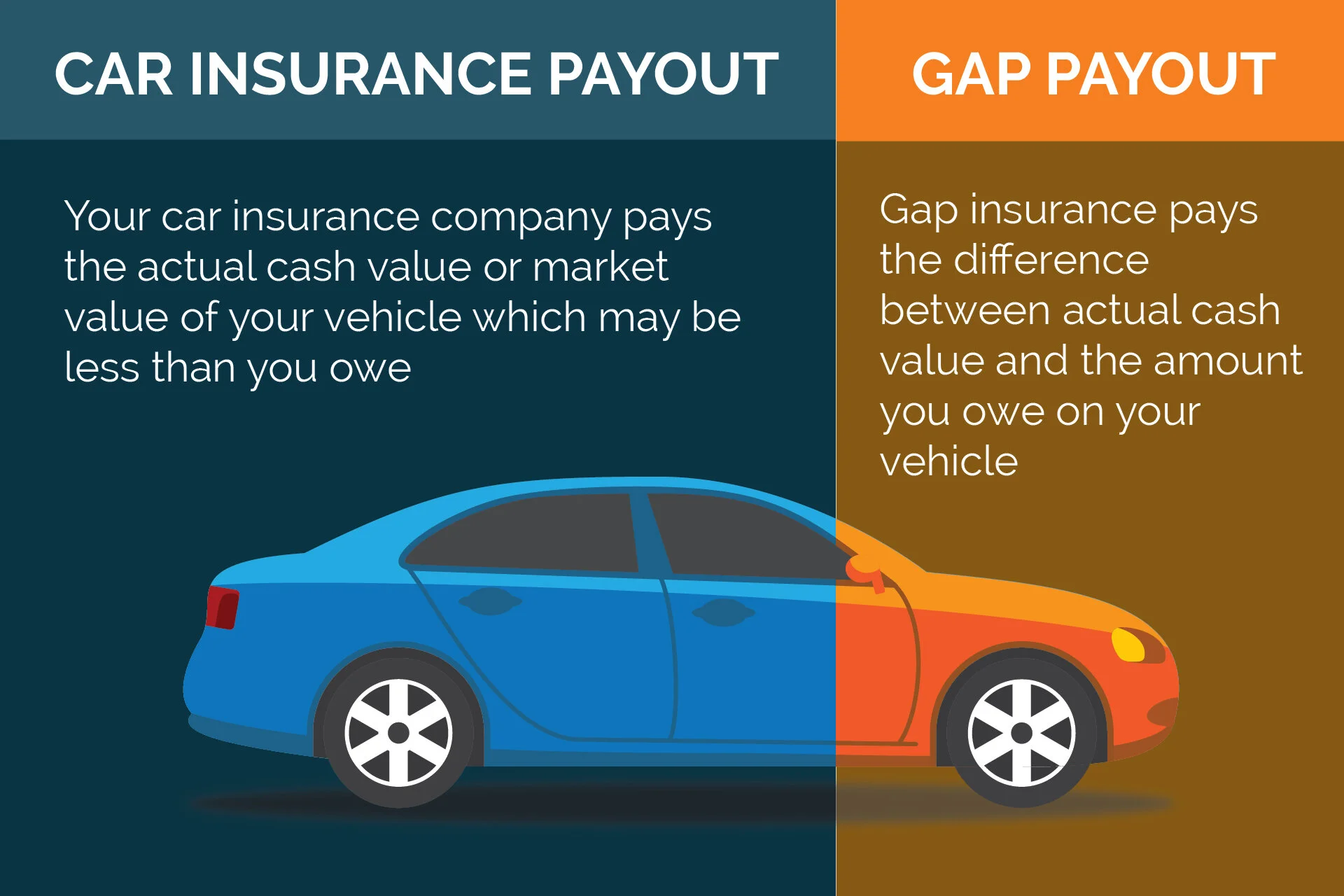

When an insurance company totals a vehicle, the only relevant inquiry is the vehicle’s fair market value; the loan balance is irrelevant. Unfortunately, a vehicle’s value depreciates significantly in the first few years after purchase, consumers often finance the purchase of new cars, and lenders sometimes require little to nothing upfront. These three circumstances result in many new car buyers being “underwater” on their auto loans almost immediately after driving the vehicle off the lot.

Gap insurance (also known as a debt cancellation agreement) covers the difference between what a person owes on the vehicle and what the vehicle is worth if an insurer totals the vehicle. In Texas, a consumer can buy gap insurance from an insurance company or through the dealership. Texas law does not require car buyers to purchase gap insurance, and a retail vehicle seller cannot require gap insurance as a condition of making an auto loan.

Why is Gap Insurance Useful?

Assume that a person purchases a new car. Several months later, a driver negligently crashes into that car, and the at-fault driver’s liability insurer opts to total the car rather than reimburse the owner for repairs. At the time of the crash:

The car’s market value is $16,000.00; but

The owner owes $20,000.00 to the lender.

Under these facts, Texas law gives the car owner the right to recover $16,000.00 as compensatory property damage. It is irrelevant that the $16,000.00 does not fully satisfy the owner’s loan balance. What happens to the $4,000 “gap” depends on whether the owner had gap insurance. If the owner had gap insurance, it would cover the difference so the owner could pay off the $20,000.00 auto loan—$16,000.00 from the liability carrier and $4,000.00 from gap insurance—and discontinue future payments. If the car owner did not have gap insurance, the owner must continue making payments to the lender on the $4,000.00 balance even though the owner no longer has the vehicle.

The bottom line is car owners who owe more than the vehicle’s value should purchase gap insurance immediately. Each day, Texas accident attorneys hear stories from car owners who chose not to purchase gap insurance, were underwater on their loans, and are stuck with payments on cars they do not have. While it may be possible to convince an insurance property adjuster to increase the vehicle’s value marginally, it is difficult—if not impossible—to help someone avoid paying off the majority of the gap.

Speak With An Experienced Injury Lawyer Immediately After a Car Accident

If someone’s negligence injures you or a loved one, you have enough things to worry about. Do not let dealing with property damage and insurance adjusters be some of them. We deal with the insurance company so you can focus on getting your life back to normal. You have one chance to do this; make the right choice by choosing the right attorney. Call us at (956) 291-7870 or email us at contact@rdjlawyer.com for a free consultation and case evaluation.