Understanding Texas Personal Injury Protective Coverage

Handling an auto insurance claim seems relatively straightforward: open the claim, gather your supporting documents, and submit them to the carrier. Often, though, this process takes months to complete. The process could take even longer if the carrier denies or unfairly undervalues a claim. As a safeguard, many motorists purchase personal injury protection (“PIP”) to help with piling medical expenses and lost wages during this uncertain time frame.

What is PIP?

PIP is first-party insurance that provides payment for reasonable expenses that arise from a motor vehicle accident. It provides “no-fault” coverage, which means the carrier must pay the policy benefits without regard to the recipient’s fault in causing or contributing to the accident. PIP policies must cover the policyholder, the policyholder’s household members, and authorized operators and passengers.

What is a Motor Vehicle Accident?

PIP covers reasonable expenses that “arise from an accident.” The Texas Supreme Court has held that a motor vehicle accident occurs when:

One or more vehicles are involved with another vehicle, an object, or a person;

The vehicle is being used, including exit and entry, as a motor vehicle; and

A causal connection exists between the vehicle’s use and the injury-producing event.

Notice that the Texas Supreme Court’s definition of “motor vehicle accident” is broader than its commonly understood meaning. The breadth of this definition permits injured victims to file PIP claims in accidents that do not involve a collision with another vehicle. For example, a driver could file for PIP benefits when his or her foot becomes entangled on the door panel while exiting a truck and falls.

What Benefits Does PIP Provide?

PIP policies must provide payment for:

Necessary medical, surgical, x-ray, or dental services;

Replacement of lost income; and

In the case of an injured person who is not an income or wage producer, reimbursement of necessary and reasonable expenses incurred for essential services ordinarily performed for care and maintenance of the family or household (e.g., child care services).

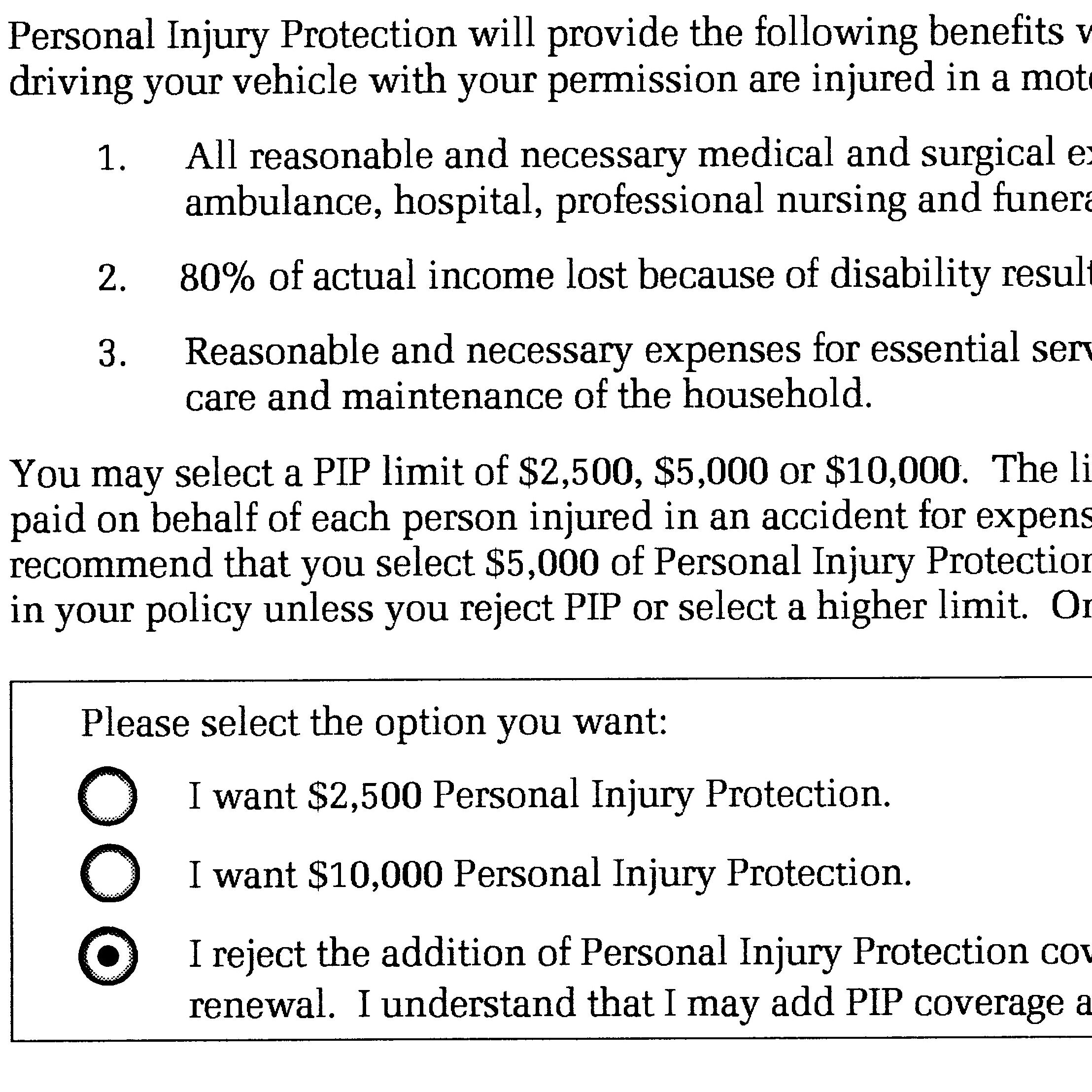

Texas insurance companies must offer PIP when selling auto policies, but the policyholder may reject this coverage in writing. If the policyholder does not reject this coverage, the carrier must provide $2,500.00 of PIP benefits to all covered persons. Policyholders may choose to purchase as much coverage as the carrier is willing to offer (usually up to $10,000.00).

What Happens if a PIP Carrier Fails to Pay a Claim Promptly?

PIP carriers have 30 days to pay a claim after receiving “satisfactory proof.” If the carrier fails to pay PIP benefits when due, the claimant may file a lawsuit to recover the policy benefits. If the claimant prevails, he or she can also recover reasonable attorney’s fees, a 12 percent penalty, and interest from the date those amounts became overdue.

How Does Med-Pay Differ from PIP?

Medical payments coverage (also known as “Med-pay”) is similar, but not identical, to PIP coverage. The most significant difference is that the Insurance Code regulates PIP but does not regulate Med-pay. Thus, insurance companies have more flexibility to restrict coverage under a Med-pay policy. Another difference is that carriers must pay PIP benefits without regard to collateral sources, which means that an injured victim who files a liability claim can also receive PIP benefits for the same injuries (unless the claims are under the same policy). On the other hand, an injured victim who receives benefits under a Med-pay policy must usually reimburse the Med-pay carrier if the victim recovers money from a third party through a settlement or verdict.

Hire an Injury Lawyer with Experience Handling PIP Claims

Since Texas law requires carriers to pay PIP claims promptly without regard to fault, policyholders should expect to receive a PIP payout faster than they should expect a liability or UM/UIM settlement. If you have a liability claim against the at-fault driver, though, an experienced crash attorney can help navigate your entire case through the claims process and, if necessary, the legal system. If your PIP carrier improperly denies or pays less than the full value of your medical bills after an accident, you have enough things to worry about. Do not let fighting with your carrier be one of them. We deal with the insurance company so you can focus on getting your life back to normal. You have one chance to do this; make the right choice by choosing the right attorney. Call us at (956) 291-7870 or email us at contact@rdjlawyer.com for a free consultation and case evaluation.