Suing a Texas Driver For More Than Policy Limits

Texas law requires all drivers to maintain a minimum level of automobile liability insurance. Unfortunately, these policy limits sometimes are not enough to compensate a victim’s damages fully. Clients who are not satisfied sometimes ask whether they can sue the driver to recover more than the available policy limits. To understand the answer, these clients must understand what liability insurance is and how it affects a personal injury case.

What is Automobile Liability Insurance?

Automobile liability insurance is third-party insurance that protects the policyholder when he or she injures a third party while using a car. In Texas, all drivers must maintain the following minimum liability coverage, known as “30/60/25 policies”:

$30,000.00 of coverage for the bodily injuries for any injured third party;

$60,000.00 of coverage for the bodily injuries of all injuries third parties; and

$25,000.00 of coverage for all relevant property damage.

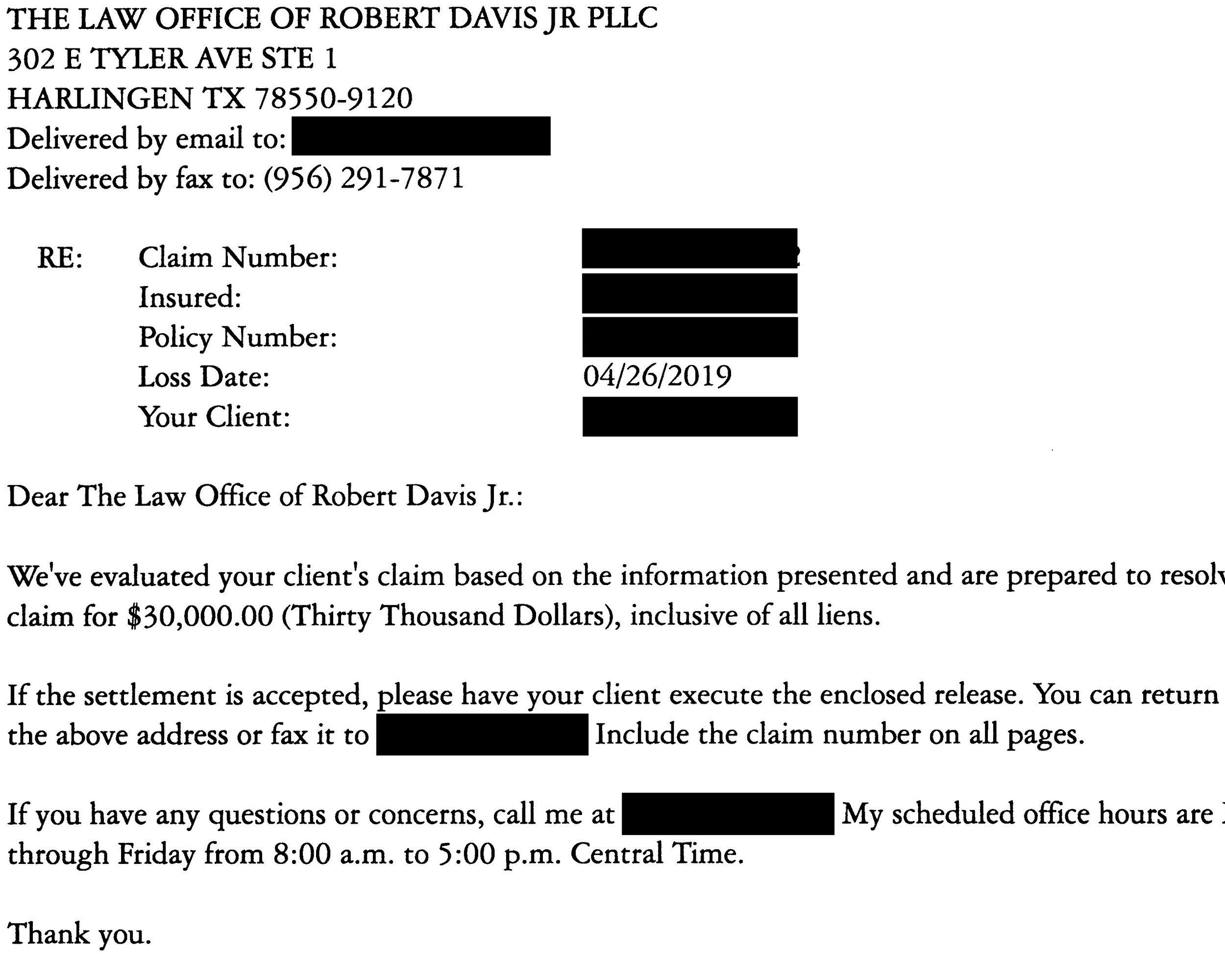

The $30,000.00 limit is known as the “per person limit.” The $60,000.00 limit is known as the “per accident limit.” To illustrate how policy limits affect a victim’s recovery, assume that an at-fault driver’s negligence injures a third party. If the at-fault driver only has a 30/60/25 policy, the driver’s liability policy will cover up to $30,000.00 for the victim’s bodily injury damages. If the at-fault driver injures two persons, the liability policy will cover up to $60,000.00 for all relevant bodily injures but no more than $30,000.00 to either victim. Essentially, the liability policy covers each person’s bodily injury damages up to $30,000.00. However, if there are more than two victims, each of them competes for their portion of the per accident limit. Since liability carriers have broad discretion in allocating the policy limits among these victims, some of these victims could find their maximum recovery does not account for their total medical expenses and other damages.

What Happens When a Liability Insurer Tenders the Policy Limits?

Most automobile liability insurance policies contain the following language: “Our duty to settle or defend ends when our limit of liability for this coverage has been exhausted.” In plain English, this means the liability carrier’s duty to defend the at-fault driver—and pay for damages caused by that driver’s negligence—ends once the carrier tenders the available policy limits.

In a perfect world, minimum liability policy limits would be sufficient to cover all damages. With the rising costs of health care, it is common for a victim’s medical expenses to exceed the $30,000.00 per person limit. As illustrated above, the situation is worse when multiple victims—each with high medical bills—are fighting for their share of a $60,000.00 per accident limit.

Can I Sue the Driver For More Than the Policy Limits?

Sometimes, an injured victim is unsatisfied even when the at-fault driver’s liability carrier tenders the available policy limits. Often, these victims will ask, “Can I sue the driver for more money? And if so, what are the chances that I win?”

Unfortunately, it is challenging—if not impossible—for a victim to recover additional funds once the liability carrier tenders the policy limits. To recover additional funds successfully, a crash victim would have to do the following:

Sue the at-fault driver;

Go through the pre-litigation process (e.g., discovery, depositions, mediation);

Gather and present the evidence to a judge or jury;

Get a verdict over the at-fault driver’s policy limits;

Pray that the driver has sufficient non-exempt assets to satisfy the judgment.

In ordinary times, this process takes several years and costs thousands of dollars. Due to the ongoing COVID-19 pandemic—and the pause it has had on our judicial system—this process could take even longer now. Additionally, the Texas Constitution and Property Code protect a person’s homestead and the overwhelming majority of his or her assets—e.g., home furnishings, motor vehicles, jewelry, and firearms—from seizure to satisfy civil judgments, like automobile accident verdicts. These generous exemptions also mean most Texans—especially those living in the Rio Grande Valley and South Texas—are “judgment proof,” a term injury lawyers use to describe those who do not have sufficient non-exempt property to take to satisfy a judgment.

Thus, when a client asks the question above, accident attorneys usually respond, “Yes, you can sue the driver for more money. Unfortunately, you probably will not collect any of it if you win, and you will spend way too much money and time trying to do so.” This answer leads to a very stark conclusion: Generally, a crash victim’s recovery is limited to the at-fault driver’s liability policy limits unless the victim has UM/UIM or PIP coverage. Therefore, the best option to avoid this fate is to purchase as much first-party coverage as possible.

Contact An Experienced Injury Lawyer Immediately After a Car Accident

Convincing the liability carrier to tender the at-fault driver’s policy limits is only half the battle. An experienced accident attorney may also help maximize a victim’s compensation by contacting the client’s providers and negotiating over-inflated medical bills. If a negligent driver has injured you or a loved one, you have enough things to worry about. Do not let dealing with the insurance company and medical providers be some of them. We deal with the insurance company so you can focus on getting your life back to normal. You have one chance to do this; make the right choice by choosing the right attorney. Call us at (956) 291-7870 or email us at contact@rdjlawyer.com for a free consultation and case evaluation.